Ramp It Up: Revolutionizing Expense Management for Businesses! Learn How Ramp's Cutting-Edge Platform Transforms the Way Businesses Manage Expense. See if you qualify >>

Review: Ramp Corporate Card

Ramp is the finance automation platform designed to save you time and money. With Ramp you get corporate cards, expense management, bill payments, accounting automation and reporting—all in one easy-to-use and free solution.

With this unique approach to financial services, Ramp has quickly become America’s #1 rated and fastest-growing corporate card. Businesses that use Ramp save on average 3.3% in year one compared to those who don’t. They close their books 86% faster every month with end-of-month close time typically reduced to just 2 hours.

Ramp provides virtual and physical cards, automated controls and approvals, smart accounting integrations, and deep insights that give you visibility into every transaction across your business. Get started in minutes, issue cards in seconds, and save hours each month so you can focus on strategy and worry less about savings.

Financials

Ramp was founded in 2019 by Eric Glyman, Gene Lee, and Karim Atiyeh, and is headquartered in New York City. The company has raised over $320 million in funding from notable investors such as D1 Capital Partners, Founders Fund, Coatue Management, and Redpoint Ventures.

Eligibility Criteria

Do you spend more than $10,000 per month on corporate cards currently?

Do have more than $75K in your primary business bank account?

Do you have influence over financial decisions at your organization or those that do?

Features & Benefits:

Smart Corporate Cards: Ramp provides businesses with smart corporate cards that have built-in spending controls and real-time alerts to prevent unauthorized spending.

Automated Expense Management: The platform automatically categorizes expenses and generates reports, saving time and reducing manual work.

Real-Time Visibility: Gain insights into your company's spending patterns and identify areas of improvement.

Integrations: Ramp seamlessly integrates with popular accounting software, like QuickBooks, Xero, and NetSuite, for streamlined expense tracking.

No Hidden Fees: Ramp boasts a transparent pricing model without any hidden fees or surprises.

Pros & Cons

Pros:

Streamlined expense management processes

Smart spending controls to prevent fraud

Real-time visibility into company expenses

Seamless integration with accounting software

Transparent pricing

Cons:

May not suit very small businesses with minimal expenses

Limited physical card customization options

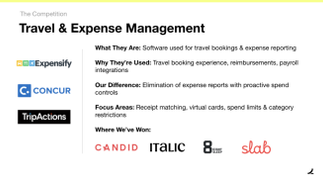

Competitors

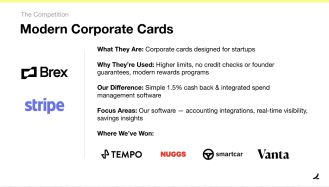

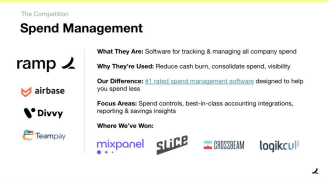

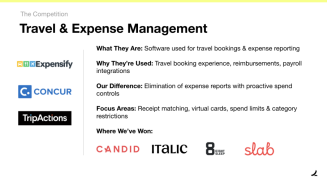

Ramp competes with other expense management platforms, such as Expensify, Divvy, and Brex. While all these platforms offer expense tracking and corporate cards, Ramp sets itself apart with its real-time visibility, smart spending controls, and a strong focus on expense optimization. Moreover, Ramp's transparent pricing model is a standout feature that sets it apart from its competitors.

Public Reviews & Ratings:

Ramp has received overwhelmingly positive reviews from its users. The platform currently holds a rating of 4.8/5 stars on G2, with users praising its user-friendly interface, robust features, and exceptional customer support.

You can read more reviews here: https://www.g2.com/products/ramp/reviews.

Available Resources:

Ramp offers a resource center with helpful articles, case studies, and webinars to help businesses make the most of the platform. Visit their resource center at: https://ramp.com/resources.

News & Press:

To stay up-to-date with the latest news and announcements from Ramp, check out the following articles and press releases:

Final Remarks

As the demand for efficient expense management continues to grow, Ramp is well-positioned to become an indispensable tool for businesses of all sizes. If your company is seeking a solution to streamline expense tracking, reduce manual work, and gain real-time insights into spending patterns, then Ramp's expense automation platform is definitely worth considering.

Furthermore, Ramp's commitment to transparency and customer satisfaction is evident in its pricing model and exceptional customer support. The overwhelmingly positive reviews from users serve as a testament to the platform's effectiveness and user-friendliness.

To learn more about Ramp and explore its features, I encourage you to visit their website at https://ramp.com and request a demo. This will provide you with a hands-on experience of how the platform can transform your business's expense management processes and contribute to overall financial efficiency.

In an ever-evolving fintech landscape, Ramp stands out as a powerful and user-friendly solution that can help businesses achieve greater financial control and make informed decisions. Don't hesitate to explore this innovative platform and see for yourself how it can revolutionize your expense management experience.

Comments