10 of the Best Online Lenders to Get Funding for ANY Reason

- Jason Feimster

- Jan 9, 2023

- 7 min read

Updated: Jan 11, 2023

The days of standing in line at your local bank to apply for financing only to wait days, weeks, and even months for an answer is all but over! And that's a good thing for consumers.

Today, online lenders and alternative financing providers are bringing the applications online through lending marketplaces. Also, they are cutting down on the approval times to in many instances, almost immediately. Again, this is all good news.

Whether you are looking for a personal loan, small business financing, or funding for a real estate project, below is a list of 10 of the Best Online Lenders to Get Funding for ANY Reason.

E-Commerce Financing Platform

Onramp plugs directly into Amazon Seller Central, streamlining the approval process and ensuring you get as much cash as possible. To determine your offer, we look at your sales history and other store details - never your personal credit. Once you’ve accepted your cash, Onramp lets you pay us back when your inventory sells. A portion of the sale of each item goes toward paying back Onramp, with only a 1-3% fee collected for our services. Yes, you read that right. Incredibly low fees and no interest paid, ever. If you have a slow month, no problem - you’ll just pay us back when business picks up.

Onramp Client Criteria

Must have a Shopify, Amazon, BigCommerce, WooCommerce, or Squarespace store

Must be a United States-based company or have a portion of their business operation in the United States

Need $150K in sales over the last year or a $150K run rate as a new seller. $7.5K in the last 30 days for Onramp LaunchPad®

We prefer to have 6 to 12 months of sales history (depending on the type of customer), with the exception for LaunchPad®

We prefer 30 to 90-day repayment terms but can evaluate longer if needed.

We currently lend between $5K and $1M but can evaluate larger requests

Business Credit Builder | Small Business Loans

To run and build your successful business, you need to qualify for loans and credit lines at the best loan rates possible. Business credit is essential to make this happen, and it helps you access money even when you can’t qualify for a loan.

The Credit Suite Business Credit Builder helps you build your business credit (without a personal guarantee or personal credit check) step by step using a proven, field tested, business owner-approved, and highly personalized process. By using our user friendly & intuitive software and the only full-service business credit adviser team in the industry, you’ll be guided every step of the way, simplifying your experience of obtaining business credit.

11 FREE Resources by Credit Suite

How to Improve Your Fundability™ and Get More Money for Your Business Faster Free Mini-Course

Unsecured Business Financing Free Training | Webinar

12+ Credit Lines You Can Get for Your Business Even with Challenged Credit (Free Training | Webinar)

50 Different Ways To Fund Your Business Right Now Free Training | Webinar

How the Credit Line Hybrid Can Help You Get Up to $150,000 in Unsecured NO-DOC Credit Cards for Your Business Even When Banks Say "No" Free Training | Webinar

7 Easy Vendors to Start Building Business Credit Immediately Free Training | Webinar

7 Easy Vendors to Start Building Business Credit Immediately Free Download

EIN Credit Guide Free Download

Business Credit Checklist Guide Free Download

Free Business Finance Assessment: Discover your Optimal Path to Improve Fundability™, Build Business Credit, and Get Business Loans Free Consultation

Your Finance Blueprint: Discover Business Financing Options you never knew you had with alternative lenders and investors. Apply Now

Small Business Financing

Based in Bohemia, New York, National Business Capital is a privately held financial services company that provides customized financing solutions to businesses of all sizes across the United States.

National Business Capital is committed to making financing easy for its customers through zero upfront fees, a three-minute application, 24-hour loan review process, and rapid loan funding compared to traditional banks. The company prides itself on its 90% approval rate for loans and has helped business owners obtain financing despite low FICO credit scores.

National Business Capital offers financing programs to meet a variety of needs, including asset-based financing, business lines of credit, commercial mortgage financing, business equipment financing and leasing, franchise funding, medical loans, doctor and physician loans, purchase order financing, SBA loans, and small business loans.

Since it was founded in 2008, National Business Capital has gained experience serving customers in diverse industries, such as transportation, medicine, construction and contracting, automotive services, hospitably, retail, wholesale, information technology, and manufacturing.

Merchant Cash Advances (MCA)

Since 2012, Uplyft Capital has financed small businesses with merchant cash advance funding. Leveraging technology, Uplyft Capital’s application and approval process is straightforward and user friendly. The cost of financing is transparent, and the lender’s tiered system gets applicants the loan amounts and terms that best suit their need.

As an MCA provider, Uplyft Capital differs from traditional bank lenders. Rather than making regular monthly payments plus interest, businesses that get financing from Uplyft Capital repay the amount with a percentage of sales revenue over the contract term.

Because of this structure, the application and approval process is easier that with other types of lenders or with backs. For applicants with poor credit profiles, this is a big advantage. Along with easy application come quick delivery. Uplyft Capital processes, approves, and deposits funds swiftly ensuring that businesses have access to funds when they need them and without hassle.

Who is Uplyft Capital for?

Business owners with low credit scores. With a minimum required credit score of 450, borrowers with bad credit may be eligible for a merchant cash advance from Uplyft Capital.

Businesses with high revenue despite short time in business. Merchant cash advances are accessible with as little as three months in business, but you’ll need to be pulling in at least $12,000 per month.

Business owners willing to pay a higher factor rate for fewer fees. Uplyft Capital’s factor rates are slightly higher than the competition, but it makes up for it by not charging any origination or monthly fees.

Business Loan Marketplace

Lendio is a business financing platform that matches customers to funders. While Lendio does not originate loans directly, its network of over 300 business funders is designed to be a one-stop shop for financing. Lendio does most of the work of finding funding for you, you are presented with multiple offers, and the service is absolutely free to use.

Lendio's online application process takes an average of 15 minutes to complete, compared with an average 25 hours filling out traditional lending applications. Small business owners are offered financing options including credit cards, lines of credit, short-term specialty loans and long-term traditional loans.

Borrower Qualifications

Any business can apply for Lendio’s services. Unfortunately, there’s no guarantee that you will receive funding; according to Lendio, only six out of ten businesses get approved for a business loan through its service.

Because Lendio works with over 300 different entities, ranging from lenders specializing in startup business loans to banks and SBA lenders, your business does not have to meet any specific qualifications to qualify for this service.

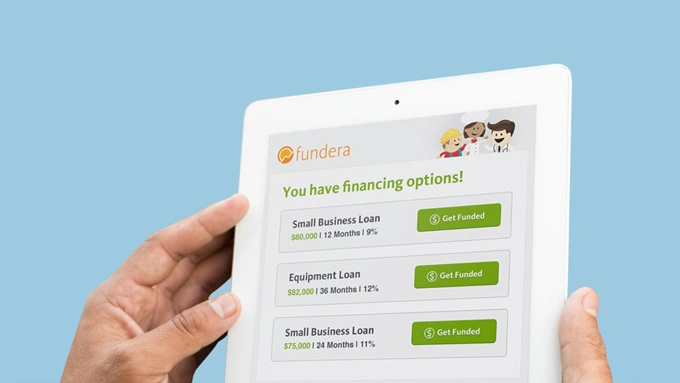

Loan Marketplace

Fundera is a business funding matchmaker. With this online service, you complete a single application, which Fundera uses to match you with suitable business financing options on offer from affiliated lenders in its network. Fundera offers guidance for small business owners to secure solutions for any of their financing needs, from credit cards to SBA loans and everything in between.

Fundera replaces small business loan brokers with software and algorithms and a singular Fundera expert, guiding any small business owner through their financial options, making the entire process faster and easier to navigate. Since launching in 2014, Fundera has helped over 85,000 businesses get $2.5B in funding.

680+ Credit Scores.

Funding as fast as 24 hrs.

Access Expert Advice.

2+ Years in Business.

Over 20 Vetted Lenders.

6% Interest Rate.

Personal Loans | Business Funding | Auto Refinancing

Upstart is a new online lending platform that partners with banks to provide business loans from $5,000 to $200,000 to small businesses as well as personal loans from $1,000 to $50,000 to individuals.

The platform combines traditional lending metrics with education, work experience, and more to help borrowers find financing that is tailored to their unique needs.

How to Get a Loan With Upstart

Check your rate in minutes 99% of personal loan funds are sent just 1 business day after signing

Verify your information Most borrowers are instantly approved

Get your money 43% lower rates as compared to a credit score-only model.*

Real Estate | Fix & Flip

New Silver is a reputable hard money lender providing funding to real estate investors. While New Silver has a particular focus on fix and flip loans, the lender also offers rental loans, ground-up construction loans and personal loans. New Silver provides ultra-fast funding, with loan closing in just 5 days and online approval in as little as 5 minutes.

New Silver offers up to $5million on their fix and flip loans, with up to 100% of construction costs covered. The rental loans are 30-year amortized for stabilized properties with the option of buying or refinancing. The ground-up construction loans are geared towards residential builders and borrowers can get access to a maximum of $5million. New Silver also has an unsecured personal loan marketplace where investors can find a personal loan that suits their needs, by comparing lenders.

From finding an investment property, to funding it, the entire process can be done on New Silver’s website. The platform offers a free platform called FlipScout, where investors can find profitable investment properties. From there, investors can contact the real estate agent or broker, then apply for funding with New Silver and purchase the home.

Real Estate | Rental Loans

Visio Lending is the nation's premier lender for buy and hold investors, offering flexible, long-term loans for SFR rental properties, including vacation rentals.

Visio Lending offers LTVs up to 80% on purchases and refinances and operates in 38+ states around the US. With 15+ years of experience, Visio Lending has closed over 13,000 loans and originated over $2.1billion across the US.

Buy and hold investors love Visio Lending because they offer:

Simple documentation with no personal DTI and no tax refund

No limit on number of loans

A streamlined qualification process

The ability to borrow as a corporate entity

Equipment Financing | Working Capital

The next generation of business funding is here. Capital City Funds is a 2019 business with the focus of helping small business owners fund their businesses. It specializes in equipment financing and working capital loans.

The company has access to 75+ trusted funding partners and can fund with FICO scores of 550+.

Comments